Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

This is AI generated summarization, which may have errors. For context, always refer to the full article.

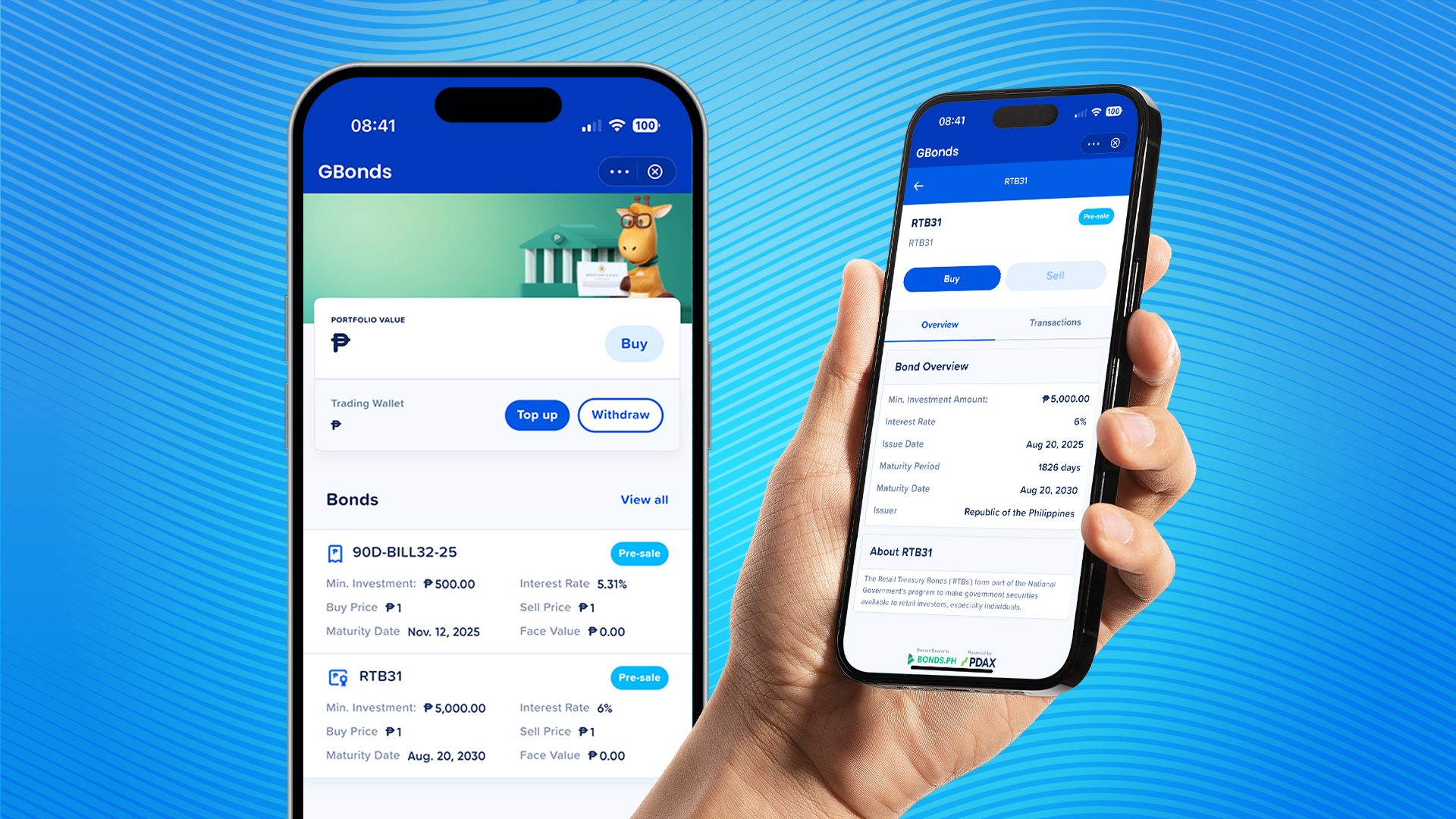

With just P5,000, the public can avail of government-backed securities like treasury bonds and bills through GBonds

MANILA, Philippines – The Bureau of the Treasury (BTr) is optimistic that its Retail Treasury Bonds (RTB) offerings will now be more accessible through GCash’s newly launched marketplace for government securities.

The BTr and GCash began selling the 31st tranche of RTBs (RTB31) through the GBonds platform on Tuesday, August 5. The e-wallet’s bonds marketplace is powered by the Philippine Digital Asset Exchange and bonds.ph.

RTB31 is a peso-denominated five-year investment due on August 20, 2030 with an interest rate of 6%. The public can invest a minimum of P5,000 and in multiples of P5,000 thereafter.

The offer period for RTB31 will run until Friday, August 15, subject to the Treasury’s discretion.

RTBs are cheap investment opportunities that help raise funds for the government’s priority projects. When the maturity date of a treasury bond comes, the government returns your investment plus interest.

Because these bonds are considered a debt obligation of the Philippine government, they are considered the safest investment in the market with very little risk of default.

In its rate-setting auction, the BTr noted that RTB31 was 11.8 times oversubscribed. This means there was higher demand than the number of securities available.

In RTB31’s case, the Treasury initially planned to raise just P30 billion in the auction, and ended up raising P210 billion due to high demand.

National Treasurer Sharon Almanza hopes the partnership with GCash will attract smaller investors to government securities. She also believes it will be a game changer for the Treasury if it can raise P300 billion in total from the RTB31 offering.

“The demand is really strong… We really wanna tap the retail investors,” she said in a mix of English and Filipino.

Aside from RTB31, fully verified GCash users can also avail of treasury bills (T-Bills) through GBonds. Unlike treasury bonds, which often hold a longer maturity date, T-Bills mature within a year or less.

– Rappler.com