Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The S&P 500 pulled back sharply from its new record – is the rally over?

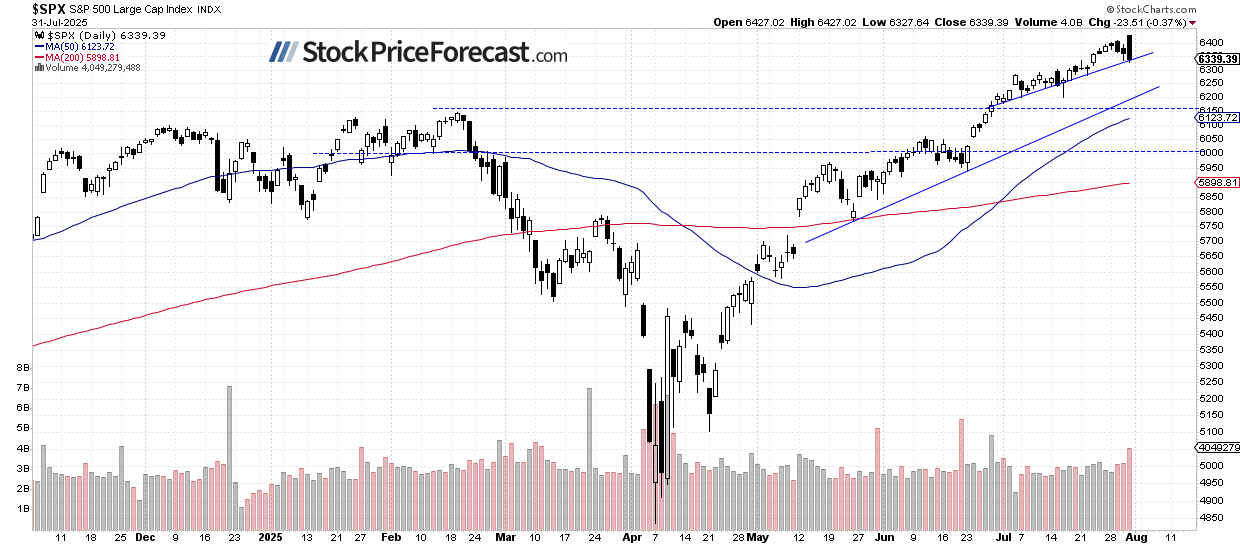

The S&P 500 closed 0.37% lower on Thursday. While that may seem like a small move, the index retreated from a new all-time high of 6,427.02, erasing its earnings-driven advance. Today, the S&P 500 is expected to open 0.9% lower following monthly jobs data, with Nonfarm Payrolls coming in lower than expected at +73,000 (vs. +106,000).

Investor sentiment has improved slightly, as reflected in the Wednesday’s AAII Investor Sentiment Survey, which reported that 40.3% of individual investors are bullish, while 33.0% are bearish.

The S&P 500 pulled back from a new record yesterday, as shown on the daily chart.

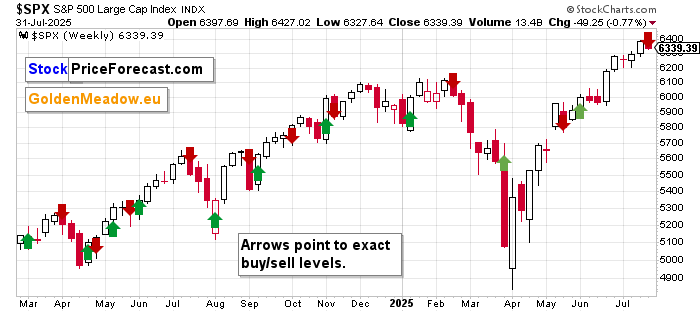

My Volatility Breakout System reversed to a short position yesterday. The strategy gained 363.94 points on its long position since June 3, improving overall performance.

It is currently positioned short, with the next reversal trigger to be posted Monday after the market opens.

This systematic approach continues to identify key market turning points and has been particularly effective during this year’s volatile conditions, outperforming S&P 500!

The system’s strength lies in its ability to capture major market moves while avoiding the noise of day-to-day fluctuations. For those following this approach, the current position demonstrates how patience and systematic execution can lead to meaningful gains.

Before the VBS reversal, an important warning signal came from Ryan Mitchell’s Seasonal Trading Primer, which suggested that the market may be nearing the end of its short-term seasonal strength.

This morning, the S&P 500 futures contract is trading just above 6,300 after touching a local low of 6,295. The index retraced this week’s gains and looks set for more volatility. Resistance is now around 6,350, with support at 6,250–6,300.

Crude oil dropped 1.06% on Thursday, pulling back from the $70 level. Prices have turned sideways as investors digest tariff-related developments. Today, crude is another 0.6% lower, trading below $69.

As I’m writing in my Oil Trading Alerts, key developments worth monitoring include:

The S&P 500 is set to open 0.9% lower this morning as sentiment weakens after yesterday’s pullback. While jobs data sparked a brief volatility, the market seems to be entering consolidation or possibly a deeper correction.

Want free follow-ups to the above article and details not available to 99%+ investors? Sign up to our free newsletter today!