Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

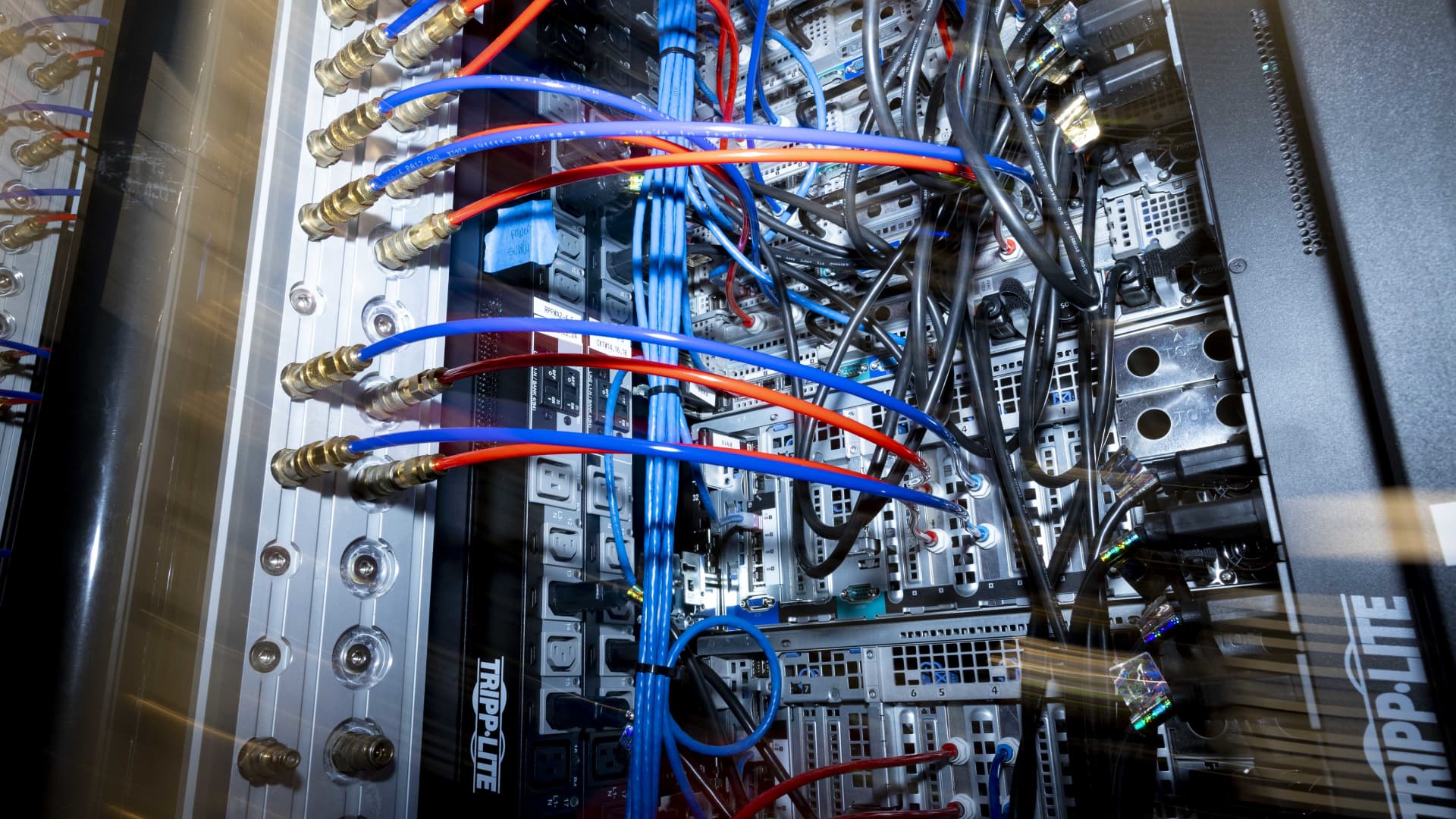

Equinix within internal operations Equinix Data Center in Ashburn, Virginia, May 9, 2024.

Amanda Andrade-Rhoades | Washington Post | Getty Images

Business: Ekioiox It is the confidence and operator of real estate investment in 75 meters from around the world. The company’s platform combines the global footprint of international business exchange (IBX) and Xscale data centers, the customer implemented, operated and maintained. Equiniix data centers are primarily in regions (female) regions (female) in regions (emea) regions (female) regions (emea) are located in regions (emea) regions (emea) in regions (emea) regions (emea) regions (emea) are located in regions (emea) regions (emea) regions (emea) regions (female) are located in regions (emea) regions (emea) regions (emea)

The stock value: $ 75.53b ($ 771.75 per share)

Equinix shares in 2025

Property: n / a

Average cost: n / a

Activist comments: Elliott is very successful and heavy activist. The company group includes analysts from private technology companies, engineering and major operational partners – General Technology and Koos. When evaluating an investment, the company also hires general specialty and management consultants, expert cost analysts and industry specialists. Elliott often clocks to companies before investing and has been stable in spectacular spectacular table. Elliott has historically based on strategic activism in the technology sector and has been a great success with this strategy. However, in recent years his team of activism has grown. The company has done much more government-focused activism and creates value from the board level in a much larger width of companies.

Elliott gave charge to Equinix.

Equinix 270 Data Centers is a reorganization and operator, 75 meters from around the world, providing neutral neutral carriers and interconnection services networks, cloud suppliers, companies and hyperscalers. Companies are increasingly based on data, and the most effective solution is to use cloud services like Equinix. The highest costs associated with building and maintenance of domestic data, combined with fluctuated data, allow collaboration companies like Equinix. Collocation data centers allow users to rent space for their hardware than to use their space. Within this market, Equinix distinguishes through data centers located next to the users worldwide, making its offers sticky for marine providers. However, from June 24 to June 26, Equinix’s shares price fell by 17.75%. This descent responded to the company’s analyst, where Equinix revealed more expenditure of $ 2025 billion in 2026 and 20% to 2029 to 2029% to 5%. Previously, it was 7% and 10%.

It has been this growth of short-term and short-term investors. It is important that Olliott has a tremendous experience with data centers. Everyone knows that Elliott is one of the most abundant assets today, but the firm establishes it is investors, director and owner / operator Data Center. Elliott run on Activist campaign to the Data Center operator switch In 2021, the investment was a seat for the director of the Elliott Senior Portfolio Jason Genior. Eventually, a sales left since sales 48.33% of the return -14.97% russell 2000 at the same time. But Elliott is more important as the owner of the UK Ark data centers and the approach. Since 2012. This is also a great experience, a shared view of the management that can have a unique relationship here.

So when the market saw Capex as a drainage that will not be paid for two or three, while the data centers are building and renting, investors such as Elliott were seen as a response to high demand. Equinix has had the tail reserves of artificial intelligence and hyperscaler growth in the last quarters. With 5% cost of capital, Capex will return 20% and 30%, for the future future future future. It is therefore expected to fall as low as 5% of 5% next year, which scares investors who know the short and less short term. As the capex spreads, it will rise to 8% in the next three years and will eventually return until 9%. That will happen without help from Elliott. There are, however, Elliott can use and amplify these returns of industry knowledge and experience as activists and operators. First, Equinix could communicate better to the market. In view of the reaction to the company’s analyst, Equinix could clearly take advantage of its capex plan around the AI strategy and long-term growth forecasts. Specifically, while Equinix does not have AI model training, it has a great opportunity to have the main role in the AI inference or to end the AI models to users. Depending on the air, the demand for inference will increase and Equiniix is well positioned for the benefit of the largest third-party data center for the world, with the key to the latest user market. There are also the options for optimizing the cost structure and optimizing small interest expenses. The management has already taken several steps in this direction and the highest goal set by the company’s 300% of the base of 300% to 52% to 52%. However, this is still a conservative estimate, many classmates, his close classmates, confidence in digital reality (DRL), they have higher margins than that. In addition, a small financial engineering can reduce and improve the interest rate of the company in Margin Equiniix.

Historically, Equinix has made a premium and his share performance has almost moved in line. However, in his analyst by day, Equiniix returns DrL has decreased approximately 11 points, and the company now works 24 times a discount Enterprise value / EBITDA By comparing DRL’s 29 times. The company is in the right way, but could use a little help to an experienced investor like Elliott, to implement his plan and communicate in the market. Elliott can do it as an active shareholder or as a table seat. Due to the company’s experience and a similar approach to management, we would not be surprised in May in May 2026 invited the Council before the next year.

Ken Squire is the founder and president of the 13D monitor, institutional research on shareholder activism and the founder and portfolio of the 13D activist fund, which invests in the 13d investment activist portfolio.