Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Gold (XAU/USD) is trading in a tight range on Monday after the United States (US) carried out coordinated strikes on Iran’s nuclear infrastructure over the weekend.

US President Donald Trump confirmed that American forces bombed three of Iran’s key nuclear facilities – Fordow, Natanz and Isfahan on Saturday night.

In a televised address from the White House Briefing Room, Trump described the mission as “a very successful attack,” warning that “there are many other targets” if Iran does not seek peace.

At the time of writing, Gold is trading below $3,370 with intraday losses of 0.15%. Traders remain focused on developments in Tehran and the status of global Oil supply routes, particularly the Strait of Hormuz.

The US coordinated strikes on Iran, dubbed Operation Midnight Hammer, involved B-2 Spirit bombers and Tomahawk missiles from US submarines. Iranian Foreign Minister Abbas Araghchi called the attacks “a heinous crime” in a state broadcast interview, warning of “everlasting consequences.” His remarks were later confirmed and quoted by Reuters on Sunday.

Iran’s parliament approved a motion to close the Strait of Hormuz — an Oil transit chokepoint for nearly 20% of global supply. The final decision now lies with the Supreme National Security Council. Oil prices spiked in response, adding to inflation risks and supporting safe-haven flows into Gold.

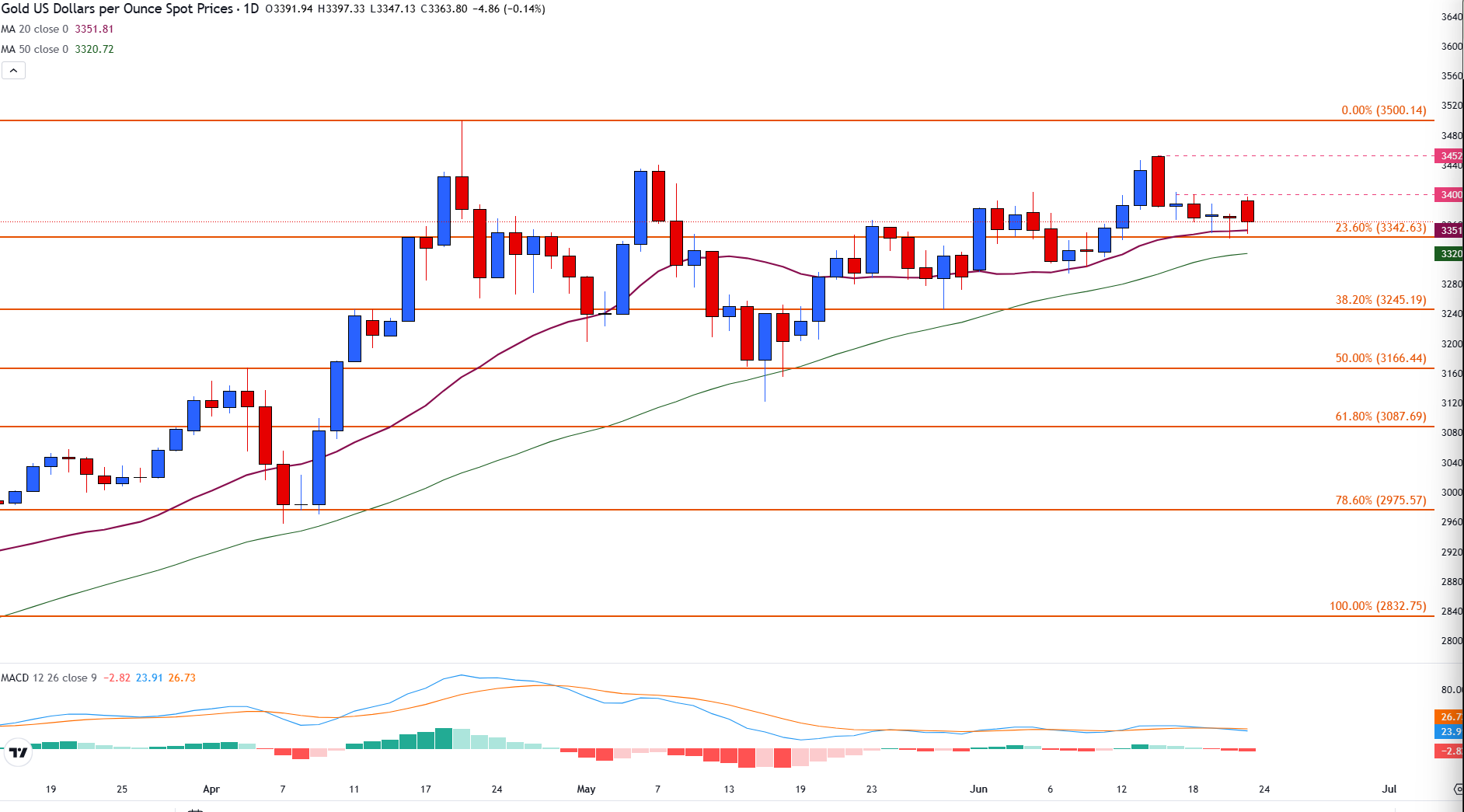

Gold (XAU/USD) remains capped near $3,370 at the time of writing, with the $3,400 zone acting as a major psychological barrier for the next big move.

Immediate support lies at $3,342, aligned with the 23.6% Fibonacci retracement from the February 28 low to the April 22 high.

Dynamic support levels include the 20-day Simple Moving Average (SMA) at $3,352 and the 50-day SMA near $3,321.

Gold (XAU/USD) daily chart

A break below $3,342 and the moving averages could open the path toward $3,245, which corresponds to the 38.2% Fibonacci retracement level.

Conversely, a daily close above $3,400 would signal bullish momentum, potentially retargeting the June high of $3,452 and the all-time high of $3,500.

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022.

Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.