Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

The Dow Jones Industrial Average (DJIA) gained ground on Friday, driven by a combination of investor expectations that the US will figure out how to secure trade deals that circumvent its own ringfence of threatened tariffs, and rising expectations of more rate cuts from the Federal Reserve (Fed) by the end of the year.

In an interview with Bloomberg News, US Commerce Secretary Howard Lutnick stated that a “framework” on trade terms between the US and China had been finalized. Commerce Secretary Lutnick went on to state that the Trump administration is expected to reach deals with 10 major trading partners. However, a White House official clarified Trump’s own comments on the matter that were made on Thursday, stating that China had agreed to “an additional understanding of a framework to implement the Geneva agreement.”

Clear communication on trade remains a challenging goal for the Trump administration. In addition to Commerce Secretary Lutnick’s announcement, US Treasury Secretary Scott Bessent stated that the Trump administration expects around 15 trade deals in the days to come. At the same time, President Trump himself proudly pointed out to reporters on Friday that he was expecting five to seven trade deals.

Never one to let a good day go unspoiled, President Donald Trump expressed ire at Canada on Friday, announcing via social media that the US would withdraw from trade talks entirely with Canadian delegates. President Trump incorrectly cited dairy tariffs that are part of his own USMCA trade agreement, which he personally negotiated during his first term to replace the North American Free Trade Agreement (NAFTA). He then announced a plan to impose tariffs on Canada within the next seven days.

Read more stock news: S&P 500 notches new all-time high despite rising inflation print

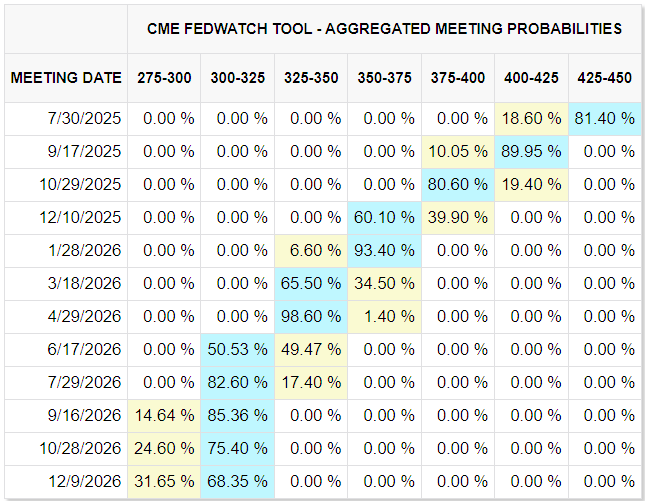

According to the CME’s FedWatch Tool, rate markets are now expecting a trio of sequential rate cuts from the Fed through the remainder of 2025, with the first rate trim widely expected in September. Rate traders are pricing in nearly 90% odds of a quarter-point rate cut on September 17, with over 80% odds of a follow-up rate cut on October 29 and around 60% odds of a third stretch for a quarter-point cut on December 10.

Markets are shrugging off a fresh spike in consumer inflation pressures after Personal Consumption Expenditure Price Index (PCE) inflation figures came in higher than expected on Friday. May’s core PCE index accelerated to 2.7% YoY, while the previous period’s print was revised slightly higher to 2.6%.

Adding further to the bad news basket, US Personal Income contracted sharply by 0.4% in May, the steepest decline in monthly income since October of 2021. Personal Spending also contracted by 0.1% in May, with both income and spending metrics widely missing their forecasts.

Investors are instead more focused on consumer sentiment and inflation expectations; the University of Michigan’s (UoM) Consumer Sentiment Index rose to 60.7 for June, ticking slightly higher. UoM Consumer 1-year Inflation Expectations also declined slightly, falling to 5.0%.

Friday’s bullish tilt saw the Dow Jones Industrial Average take a fresh run at the 44,000 handle, a level the major equity index hasn’t touched since March. Despite some last-minute hesitancy that saw the Dow Jones ease back into the 43,500 area, the week is poised to end on a firm note, with the Dow trading over 3% higher from the previous week’s close.

Bullish momentum continues to keep DJIA prices grinding higher, but steeply overbought technical oscillators are flashing firm warning signs that a downside pullback could be on the cards. A near-term easing back to the 50-day Exponential Moving Average (EMA) near 42,200 can’t be ruled out.

The Core Personal Consumption Expenditures (PCE), released by the US Bureau of Economic Analysis on a monthly basis, measures the changes in the prices of goods and services purchased by consumers in the United States (US). The PCE Price Index is also the Federal Reserve’s (Fed) preferred gauge of inflation. The YoY reading compares the prices of goods in the reference month to the same month a year earlier. The core reading excludes the so-called more volatile food and energy components to give a more accurate measurement of price pressures.” Generally, a high reading is bullish for the US Dollar (USD), while a low reading is bearish.