Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

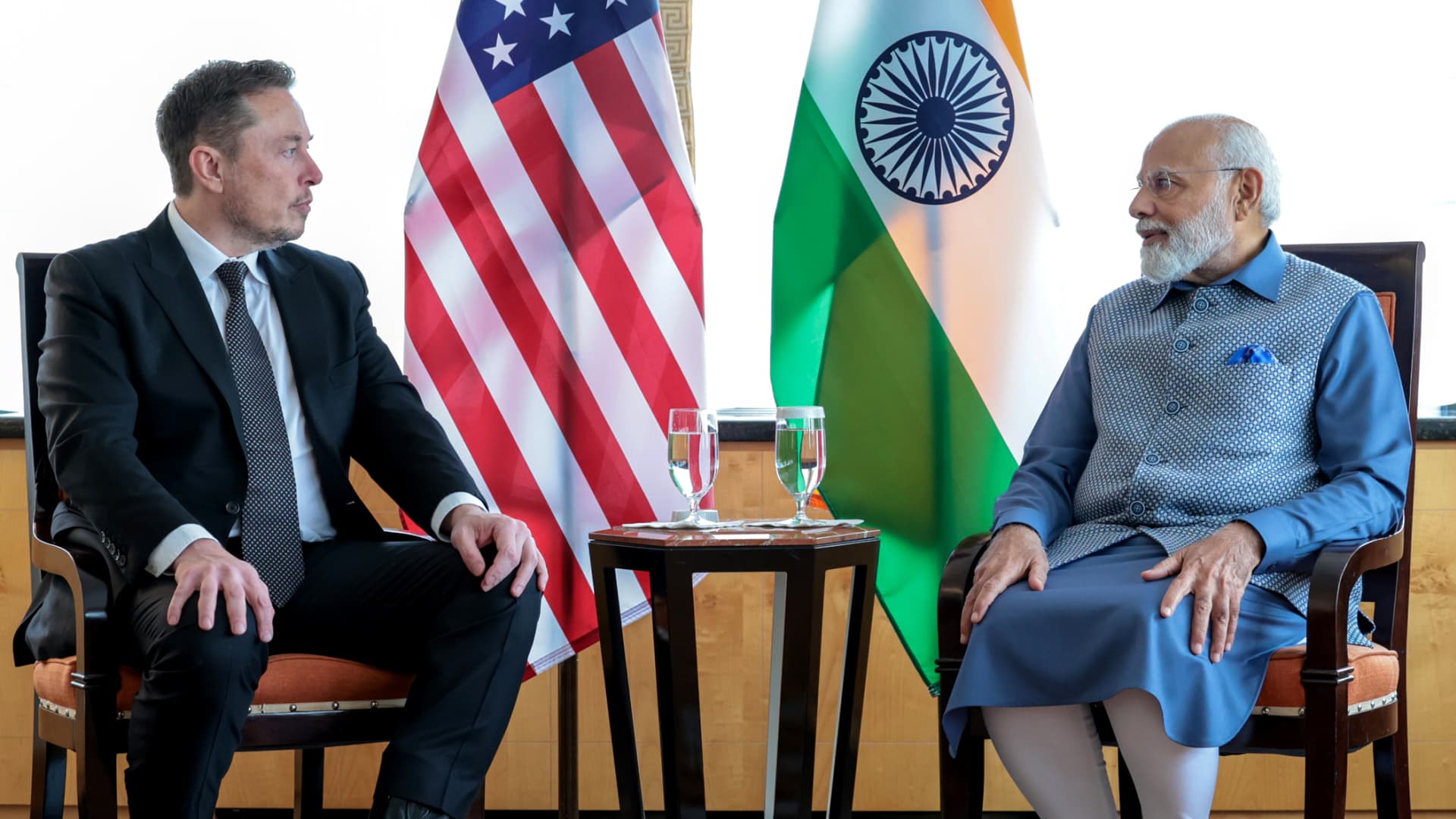

Indian Prime Minister Narendra Modi meets Elon Musk in USA on June 20, 2023.

Press Information Bureau of India | Anadolu Agency | Getty Images

This report is part of this week’s CNBC “Inside India” newsletter, which brings you timely, insightful news and market commentary on the emerging powerhouse and the big businesses behind its meteoric rise. Do you like what you see? You can subscribe here

President-elect Donald Trump is less than a week away from being sworn in and has promised a flurry of activities since day one.

The key policy – which worries global investors but is also seen as beneficial for India – has been Trump’s pledge to reduce tariffs on all imports from China.

Economists expect India to benefit from US-China trade as American companies try to diversify their supply chains.

“There are a number of ways this could all play out, but India and Indonesia may prove to be the biggest and immediate winners from Trump’s tariffs; they don’t appear to be at Trump’s destination, they have relatively low geopolitical risks, and they have large and fast-growing domestic markets,” said Shilan Shah. and Marcel Thieliant of Capital Economics.

However, many analysts have also predicted that US manufacturing is unlikely to revive due to tariffs alone. Instead, import taxes are likely to lead to a spike in inflation without economic growth, which Trump wants to avoid.

“Trump has seen how corrosive inflation was to the Biden administration’s electoral support, and will need the disinflationary offset of inflation that can come from tariff and immigration cuts,” said Thierry Wizman, global FX and rates strategist at Macquarie.

Recent whispers in Washington suggest the tariffs are unlikely to be extensive. Scott Bessent, the hedge fund billionaire and Trump’s pick for Treasury Secretary, will also share his views on US trade policy today. Senate confirmation hearing this reinforces the idea of purposive duties.

However, it is another billionaire – Elon Musk – who will have a major influence on America’s trade policy with China, which could be detrimental to India’s economic growth.

Musk, as the leader TeslaIt has enormous economic exposure to China through the automaker and wants to resolve trade policy between the two superpowers as quickly as possible rather than let tensions rise.

There is also the possibility that the Chinese government sees Musk as an operator who can help ease tensions between Beijing and Washington. China is now said to be considering a plan Musk, who also owns social media platform X, is acquiring TikTok’s US operations so that the application is not effectively banned. TikTok has denied the reports and said it will not sell its US operation.

While Musk is not alone in having business interests in China, he is in the inner circle of the future president’s closest advisers and could play a crucial role in a US-China trade deal.

“It would certainly be a negative outcome for India if the US were to strike a deal with China,” said Gaurav Narain, senior adviser to the London-based list. Capital Growth Fund of India. “Companies are clearly looking at alternatives to China, which presents a significant opportunity for India.”

“However, if a deal is reached, the need to find an alternative would disappear as China remains more cost competitive and has a complete supply chain,” added Narain.

The Tesla boss has also previously gone public with India’s “far and away the world’s” highest taxes on car imports. Far from being pro-India, Musk, who now has Trump’s ear, could inflame trade tensions between India and the US over India’s import duties.

In an attempt to woo Musk and partly divert attention away from his tariff policy, the Indian government lowered import taxes on electric vehicles to 15% in 2024 after many decades of keeping them at 100%.

However, economists suggest that Trump has surrounded himself with enough China hawks that even when a trade deal is reached, it will only lead to business moving out of China, rather than stopping it altogether.

“I think the case for that investment may be slowing (into India) because companies are looking at it and thinking, ‘Oh, we’ve got another four years,'” said Michael Langham, India economist at asset manager Abrdn. . “I don’t see companies thinking in the short term to not plan ahead for what is a longer-term trend, which is the diversification of supply chains.”

Others also suggest that in addition to the trade tariffs imposed by Trump during his first administration, the Covid-19 pandemic has also contributed to the corporate strategy of moving away from China.

“I think the reasons why companies are relocating their supply chain are much deeper and therefore more likely,” Sonal Varma, head of India economics at Nomura, told CNBC in an interview in late December. “The trade imbalance between the US and China, I think, is a small part of what is really a bigger problem,” Verma added.

There’s evidence that even Musk hasn’t always gotten his way with Trump.

The Tesla chief backed Howard Lutnick, CEO of investment bank Cantor Fitzgerald, as his choice for Treasury secretary. However, Trump chose billionaire hedge fund manager Bessent to lead the US government’s finance department.

Slowing inflation in India. December inflation in India rose 5.22% per yearAccording to the Ministry of Statistics and Program Implementation. The reading was lower than the 5.30% forecast in a Reuters poll of analysts, and the second month in a row that inflation has slowed. Softer inflation reading gives room for RBI to cut rates, amid slowing growth in the country.

China may delay exports to India. Shri S. Krishnan, the country’s secretary in the Ministry of Electronics and Information Technology, said on Tuesday that the government has received feedback from industrial companies, such as Foxconn, They were maintaining capital equipment in Chinese ports for several months. China has not announced formal restrictions, but the move could be led informally by Beijing, Krishnan said.

The Indian government sees no problem with currency or oil supply. The Indian rupee has depreciated against the US dollar this week, but the government has sufficient foreign exchange reserves prevent excessive currency movementsgovernment sources said. The government is also confident that India will not face oil shortage or price hike after the US imposition New sanctions on Russian oilof which India is one of the major buyers.

Exploiting Opportunities for Profits in India. India’s economy is experiencing a slowdown. But its growth aspects, according to the United Nations forecast, are still strong compared to other global markets. One of the best ways play the Indian market can be opportunitiesaccording to a senior strategist at an investment firm. (For subscribers only)

Indian stocks seem to be recovering from a terrible start to the year. The Nifty 50 the index fell by 0.5% this week, but has been trending upward in recent days. This year the index fell by 1.41%.

The benchmark 10-year Indian government bond yield briefly rose 10 basis points in the past week but fell to 6.75% on Thursday.

On CNBC TV this week, Neelkanth Mishra, chief economist at Axis Bank, said that the Indian rupee is facing a problem of being “impossibly stable”. In the last two years, the rupee’s volatility was more limited More than any other currency in the world, Mishra said. That’s because the Reserve Bank of India had a policy of stabilizing the currency, and that stance may remain “much longer than necessary,” according to Mishra.

Meanwhile, Sumeet Jain, senior research analyst at CLSA, told CNBC that valuations of names in India’s IT sector “have been battered in the past two years despite declining earnings.” However, it is Jain”cautiously optimistic“about the sector, as macroeconomic conditions in India are on the upswing.

Laxmi Dental, a manufacturer and exporter of dental products, listed on Monday. Keep an eye out for China’s GDP and retail sales data on Friday.

January 17: China’s fourth-quarter gross domestic product and retail sales for December, latest reading of euro zone inflation rate for December

January 20: Laxmi Dental IPO, China’s prime lending rate decision

January 23: December Japan trade balance, January eurozone consumer confidence data