Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

BBC News and 4 files research

BBC

BBCRussian Oligark Russian Abramovich suggests that the UK could owe $ 1 million to tax on the investment of coverage funds, suggests the evidence observed in BBC.

Paper filtrations revealed investments in $ 6 million (£ 4.7 million) in the Virgin Islands of Britain (BVI). But evidence suggests that they were managed in the UK, so there should be a tax.

When Chelsea FC was funded by Mr. Abramovich, it can be found to companies involved in the regime, also found in the BBC and Research Journalism Bureau (TBIj).

The Osterers said to “always expertise tax and independent legal advice” and “act according to this advice.” It is not known to be or responsible for personalized tax or personally unpaid tax.

Joe Powell, Joe Powell, work with a group of tax-taxing, HM entries and customs are called “urgent” “very important amounts of money that may be invested in public services” to recover the case recovery case.

In the heart of the regime, the former director of Chelsea FC, now his right Chelsea FC director and employer, is questioning the decision of government in the UK with Lord Link.

Mr. Shvidler moved to the US after the invasion of Russia’s Ukrainian invasion, but from 2004 to 2022 he lived in the UK, Properties in London and Surrey.

A tax expert said Mr. Shvidler did strategic decisions based on investments based in the UK, and not in BVI, it was “a relatively large smoking gun, proposing that the company should pay for the UK tax.

The lawyers made by Shvidler said the BBC “business documents” presented in an incomplete image and drawn strong and improper consequences and the behavior of Mr. Shvidler “.

The “investment structure” said it was the subject of “major tax advisors and the subject of consulting tax advice theme”.

The outline involved in the Abramovich Hedge fund investment revealed the BBC and the Research Journalism Office for more than a year in a huge data escape. The thousands of files and emails of a Cyprus-based company and email administered the global empire of Mr. Abramovich.

Getty Images

Getty ImagesBBC and its media partners, including the tutor, has reported filtered files since 2023 as part of the International Association of Research Journalists Cyprus confidential Research. On Tuesday, Mr. Abramovitx revealed how he had Millions gave VAT, the costs of the sailing fleet.

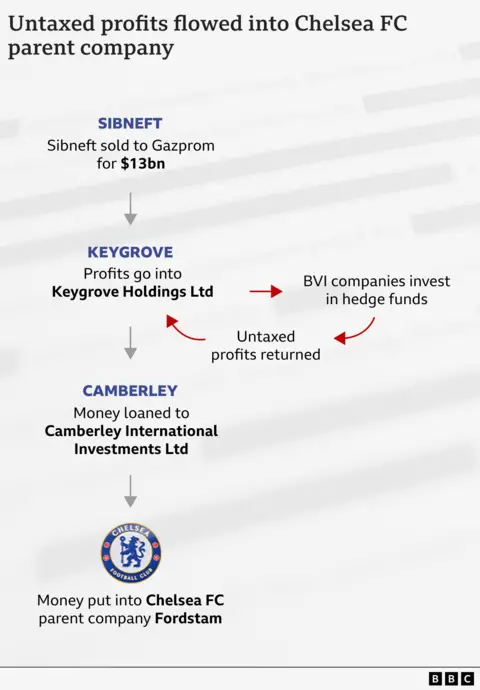

The spilled data shows how Abramovitx invested a large portion of the wealth he gained in the 1990s A rotten agreement – KeyGrove Holdings Ltd. Access to a Bviko company.

British Virgin Islands, Keygrove’s owned company invested this money, up to 6 million (£ 4.8bn) in the late 1990s and in the early 2020s, according to filtered files.

These investments calculated $ 3.8 million ($ 3.1 million) for almost two decades. Investments by making BVI through company companies, which does not require a profitability tax, to ensure that the scheme is set as low as possible.

It is not uncommon for businesses to pay for their profit tax, making investments in tax paradise companies. However, companies involved must be entered and controlled.

If the strategic decision of the offshore company takes someone in the UK, his profits could be taxed as if it were a UK company.

Disclaimed documents show that the directors of BVI investment companies were thrown in front of Mr. Shvidler, lived in the UK and obtained British citizenship in 2010.

BBC has seen “General Power” documents between 2004 and 2008, “all the most widespread powers” and “all without a protection” and BVI investment companies gave him “full power”.

Since 2008, Mr. Shvidler seems to have gained the capacity to direct KeyGrove investment in BVI companies.

The Millennium Capital Ventures Ltd, who was owned by Mrs. Cross-Shakan’s wife and 2000. He was appointed as a director in KeyGrove’s investment manager. The “full power and authority” was assigned to supervision and correction of asset investment, “without prior consultation with the customer”.

The main roles of Mr. Shvidler in the investment decisions of BVI, created in a lawsuits brought in September 2023, against the New York Commission in New York.

SEC filing says Concord had only one customer, as I identified as Mr. Abramovich. The company mentioned investment decisions for BVI companies in Oligarch.

Identifies a “long-standing link” of Lord Abramovich, named “B”, “investment decisions” for Mr. Abramovich.

“It has been a contact for deciding or communicating the decision to be made to receive investment advice” and “recommended transactions”.

Using spilled documents, BBC was able to identify “B person” as Eugene Shvidler.

The evidence suggests that Mr. Shvidler is making decisions that manages and controls Mr. Abramovich’s investment, rather than BVI in the UK.

Getty Images

Getty ImagesRita de le Fereia tax experts in the UK residents, such as Mr. Shvidler, Mr. Shvidler, was taking the “big decisions” in the investment of the fund “clean expression”.

“I think this smoking gun is pretty big. That would be, once again, that the effective company management was not happening in BVI,” he said.

Shvidler’s lawyers said “It is not necessarily known or neglected to participate in a unlawful scheme to prevent tax payment.”

Mr. Abramovitx said he managed to obtain his advice in tax issues, “he hopes that those who are responsible for those who direct companies” related to him “.

Embed documents Abramovich’s non-investment of coverage funds have been large amounts to Chelessea before leaking to FC.

The investment of the coverage fund entered its companies in Bvia and then in KeyGrove, the company’s company.

Keygrove gave money to other companies on the Mr. Abramovich network, which is a business configured by the Camberley International Investments Ltd – Bankroll Chelsea FC.

2021. When Chelsea won the Champions League, Club World Cup, when he won UEFA Super Cup, club loans could delay hundreds of dollars to benefit from companies without investment in Abramovich’s Hour.

If you are researching HMRC, how much could Mr. Abramovititk or companies owe?

We rated profits made by BVI investment companies from 1999 to 2018.

Discards spilled only for companies that invest in coverage funds for 2013 to 2018.

However, how much money they took the involved companies may have been made throughout the time in view of the “income bookings”. These are the benefits stored in companies, rather than pay for shareholders. 2018. At the end of the year were $ 3.8 million.

Request tax and currency conversion rates for the UK 2012 income reserves and annual profits for 2018, HMRC debt tax bill over £ 500 million.

Getty Images

Getty ImagesIf you have any questions about the unpaid tax, HMRC can also impose late payment interests and penalties to inform the authorities.

If the tax was underpass, whether a study concluded, he concluded that he did not know, but he did not know, the amount did not know about £ 7 billion more than £ 1 million.

A profit tax could not be recovered, HMRC studies could not be back to a maximum of 20 years.

However, it is also likely to underestimate our calculations, because we have applied the lowest rate on corporate taxes between 1999 and 2012, and it is possible to have taken our profits from the companies of the time we have not entered ours. amounts.

In any case, Abramovich’s tax bill could be a dwarf Bernie Ecclestone Boss Boss Boss imposed in formula £ 653 million In 2023.

Following the invasion of the Ukrainian scale of Russia, the Government of Government Roman Abramovich allowed Chelsea FC to the Todd Boehly. Therefore, £ 2.5 million money would be given to charities that protects victims of war in Ukraine.

Almost three years later, the money barclays is still in a frozen account of the bank, Mr. Abramovitx wanted money to go to all the “victims” war, and the UK should spend only about humanitarian support in Ukraine.

BBC’s research suggests that Ukrainians are waiting for the money of a former chief Chelsea, so British is taxpayer.

Cyprus confidential International cooperation research has been launched in 20023 by the International Association of Research Journalists (ICIJ) in Cyprus companies, corporate and financial services on Russian President Vladimir Putin.

Media Partners Tutor, research news Trail Paper Trail Multimedia, Italian newspaper L’Espresso, crime and corruption report (OCCRP) and research journalism office (TBIJ).

TBIJ Reporting Team: Simon Lock and Eleanor Rose.