Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Federal Reserve (Fed) Chairman Jerome Powell will testify before the US House Financial Services Committee on Tuesday. Investors will look for fresh hints on the timing of the next policy action after recent comments from Fed policymakers showed a difference of opinion.

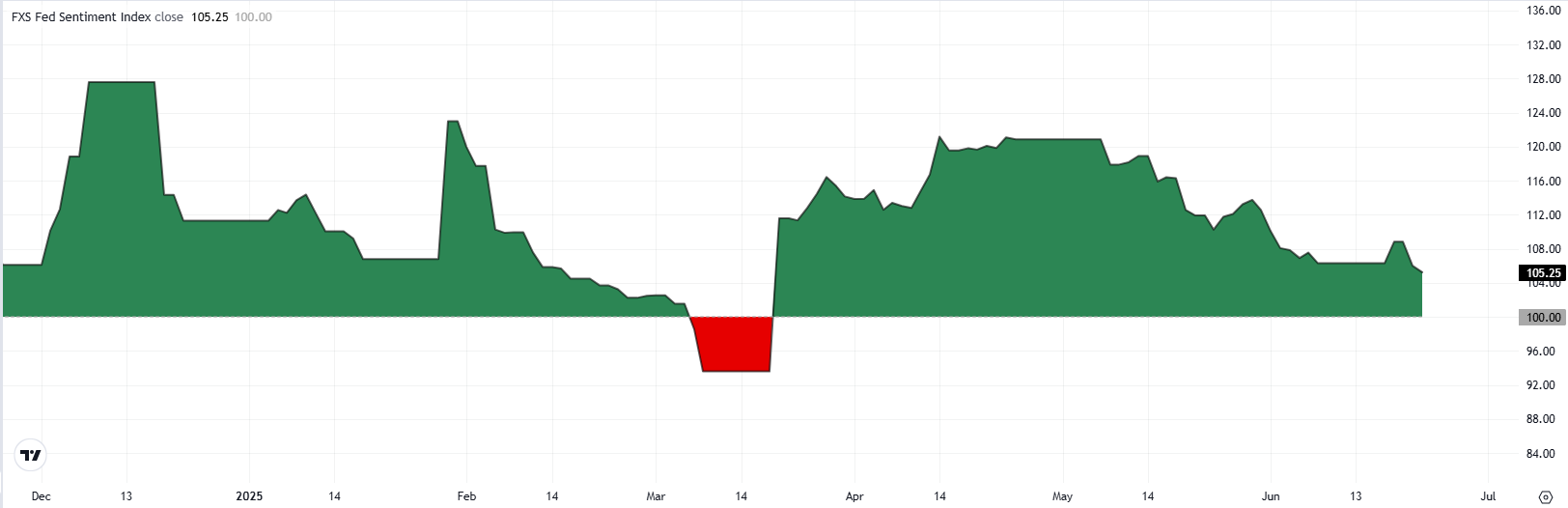

FXStreet (FXS) Fed Sentiment Index rose to 108.84 following the June policy meeting, at which the US central bank decided to leave the policy rate unchanged at the range of 4.25%-4.5%. In the post-meeting press conference, Powell reiterated that they have to keep rates high to get inflation all the way down and noted that they need to see more data before taking policy steps.

On a dovish note, however, Fed Governor Christopher Waller told CNBC last Friday that the Fed is in a position to cut the policy rate as early as July, arguing that they should not wait for the job market to crash to start easing the policy. Similarly, Governor Michelle Bowman noted on Monday she would be in favour of lowering the policy rate at the next meeting if inflation pressures stay contained.

Following these comments FXStreet Fed Sentiment Index declined to its lowest level since March at 105.2. Although the Index remains above the neutral line at 100, it highlights a less hawkish Fed tone overall.

According to the CME FedWatch Tool, markets are currently pricing in about a 20% probability of a July rate cut and an 80% chance that the policy rate will be lowered by at least 25 basis points by September.

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates.

When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money.

When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions.

The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system.

It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.