Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

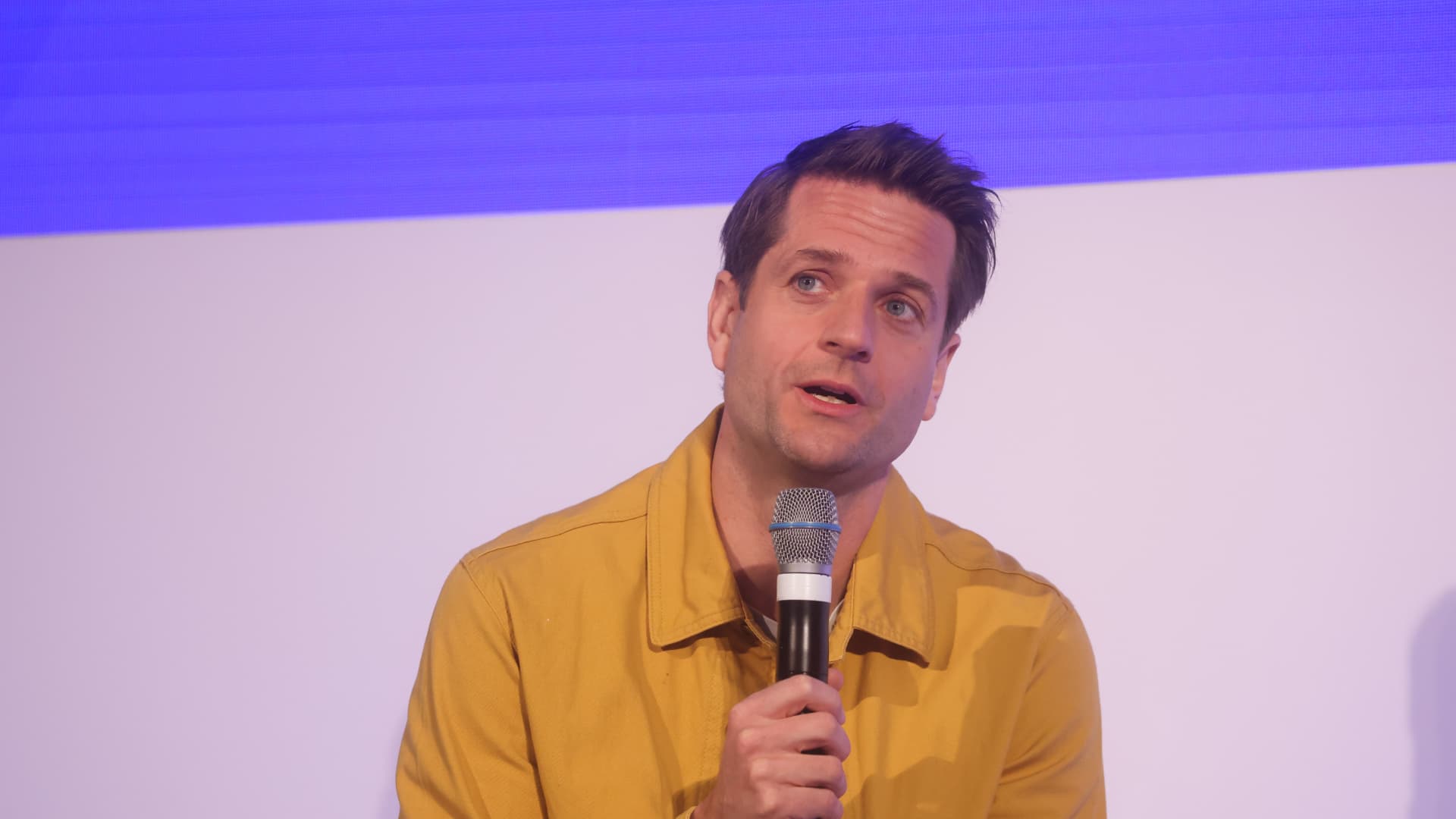

Sebastian Siemiatkowski CEO of Clarna, speaking at a London FinTech event on Monday 4 April 2022.

Chris Ratcliffe | Bloomberg via Getty Images

Klarna’s General Manager, so FinTech’s 100 million users banking reports the artificial intelligence that is changing every day.

Wednesday, Klarna – “Buy Now, Pay Then” Payment “(BNL) – is launching mobile phone plans in the US in the US, in collaboration with concerts for starting telecommunications services. The movement continues in the footsteps of FinTechs Revolut and the N26 enemies, which have placed similar offers. Klarna’s plans have unlimited data, calls and texts and will cost $ 40 per month.

The offer of the new Telco Aligns Sebastian Siemiatkowski’s view of the Section. Clarna can provide services outside the framework of traditional finance “It is a custom custom application.

No company’s first attempt. Previously, he was similar to a “Super Application” Klarna, similar to Alipay of Ant Tencent’s Wechat Pay – Offering additional services through various different buttons. This was the “confusing customer”, however, SiemiaTkowski told CNBC in an interview.

But Klarna Boss stressed the AI part to diversify his services and discover more than its BNL offer.

“Oh in this new world I think the better option to serve different services to customers and then aged the articulation and display level of these services,” Siemiatkowski said.

“With air, you can experience much more abstract and you can take much more,” he added.

Super applications are well known in China and other Asian places. They will serve as a single store store for all mobile needs. For example, it is to pay for taxi hail and food and sort in the same place as messaging services.

However, while Super Apps flourished Asia, it has been adoption in the western markets, however slower for a variety of reasons.

Siemiatkowski said he is going to spend a lot of his time by focusing Ain.

“It’s a great opportunity to do so, but it’s just to work,” he said. “Everyone used to know that they can throw some exciting things, but then you need to make sure that every time it works.”

Going forward, Klarna’s leader makes the platform “a digital economy” for user banking needs.

“If we suggest that your carrier subscription or data is exaggerated,” SiemiaTkowski says Klarna aims to use AI, but also to make it a click, setting that and making it a reality. “

Recognizing problems with the previous attempt at Klarna, SiemiaTkowski says technology did not have enough “mature” at the time.

“Finally, the North star of all financial products – especially FinTech Company – is trying to be a financial advisor in your pocket,” Simon Taylor, Sardine.ai, CNBC. “This private banker like experience, but becomes super-aggregator of the financial life given by a brand and that is the” customer owner “AI at age.”

Taylor added that many companies need to use AI, “you’ve got companies like the Klarna building to try to catch the market share for the future and yet.”

Empty Reported a loss of $ 99 million It was completed in March in quarter, referring to redemption, shares-based pay and restructuring costs.

However, clarna has a problem of perception. In the US, “Buy Now, Pay Then” It has become a payment method.

On the contrary, European consumers recognize that they can use Clarna to store deposits and pay things, as well as by a credit plan according to Siemiatkowski.

He also expressed frustration with memories like the reports we enter in the US “, ‘, was launched by Klarna Doorash … it is a sign of macroeconomic environment, “to mention a Tie-up company advertised with food shipping application Doordash This year’s year went back online.

Siemiakowski said this type of reaction was not going to happen in Germans or nordic, where the charna works as a Paypal of the online payment system.

He sees the future when Klarna culturates a more financial ecosystem, such as characteristics of investments in stocks and cryptourcurrences.

“It is the ability to invest in both people and crypto, it is becoming a more standard part of a neobank offer,” he said, while stressing, does not compete with the known US Stock Trading application Rob.

Empty Plans to go public in April were pausedAfter the President of the US Donald Trump, he announced extending fares in dozens of countries.

Siemiatkowsk said Klarna has already got what to do to do for this milestone, namely a brand in the US

“The US now is our largest market according to the number of users. It’s a profitable market for us,” he said. “These things are filled.”

Whether it makes public company, Klarna’s business strategy remains the same.

“That’s a healthy way to drive liquidity for our shareholders, as well as giving them more ways to finance the company, and …” SiemiaTkowsk said. “