Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

This is AI generated summarization, which may have errors. For context, always refer to the full article.

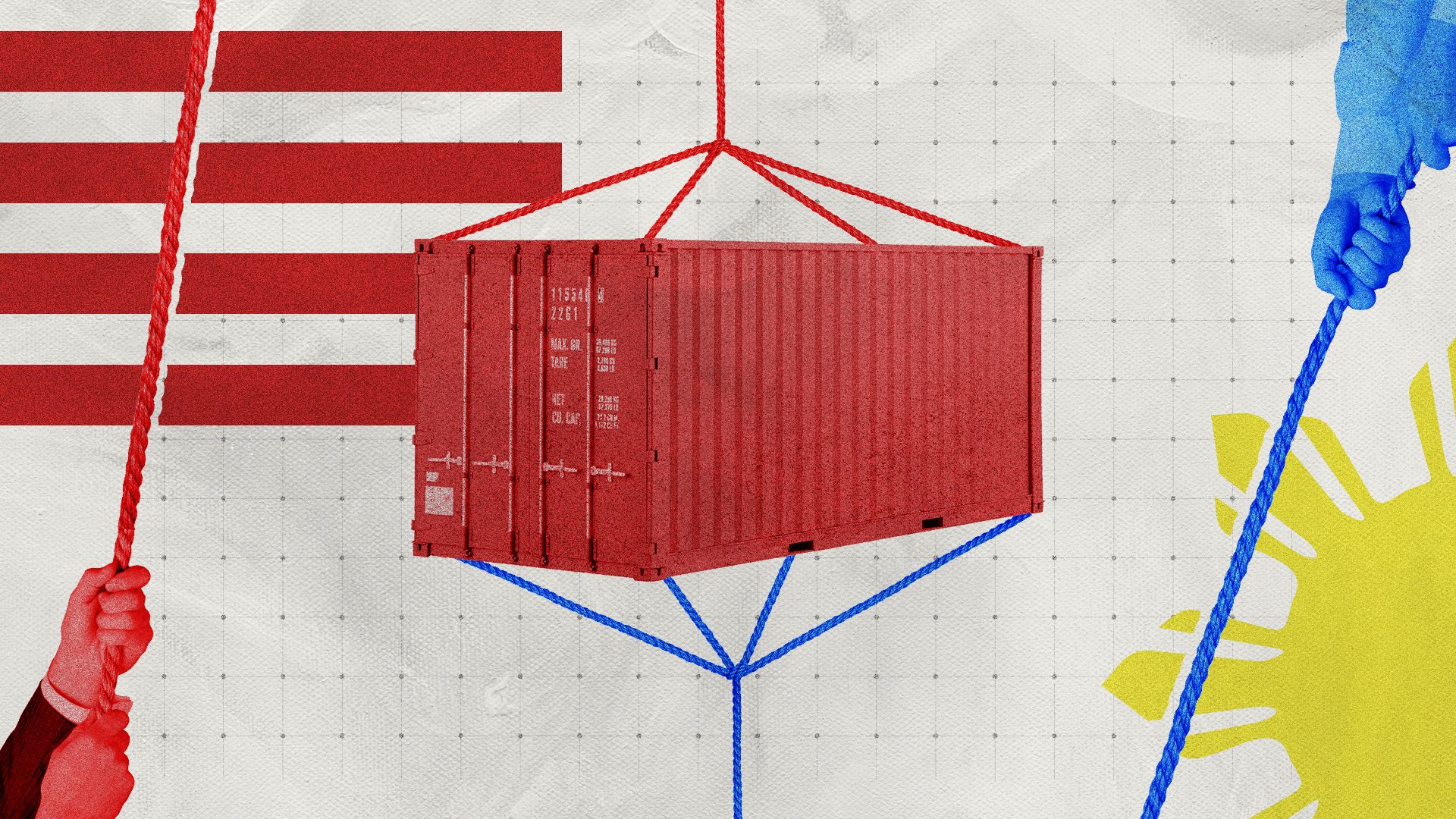

Donald Trump’s imposition of reciprocal tariffs presents an opportunity for the Philippines to negotiate a more sustainable and mutually beneficial economic partnership with the US

President Donald Trump’s flexing American strength throughout the world could mean trouble for allies of the United States in the Indo-Pacific region.

This early, we’ve witnessed how the US has been economically decoupling from its long-time allies, a move that could have significant ramifications for Southeast Asia, considering the region’s strategic position between America and China.

As Trump prepares to impose reciprocal tariffs on the Philippines, a brewing trade battle threatens to reshape economic ties between the two nations. With the US trade deficit with the Philippines soaring to $4.9 billion in 2024, Washington is pushing back against what it sees as unfair tariff imbalances.

Will these aggressive measures force Manila to lower trade barriers, or could they spark a deeper economic standoff? Let’s dive into the key concessions at stake and how this high-stakes move could impact businesses, consumers, and the future of US-Philippine relations.

The United States is poised to take a more aggressive stance on trade with the Philippines as President Trump prepares to impose reciprocal tariffs to counter existing trade imbalances. The move comes amid a widening trade deficit and tariff disparities that have long favored Philippine exports. According to the Office of the US Trade Representative, the US goods’ trade deficit with the Philippines reached $4.9 billion in 2024 — a 21.8% increase from 2023. The Trump administration is seeking to level the playing field and secure more favorable trade terms.

In 2024, total goods trade between the US and the Philippines reached $23.5billion. US exports to the Philippines amounted to $9.3 billion, marking a slight 0.4% increase from the previous year, while imports from the Philippines surged to $14.2 billion, a 6.9% rise from 2023. This growing gap underscores the need for a recalibrated trade strategy.

A major point of contention is the tariff imbalance. While US goods entering the Philippines face an average tariff of 5.5%on non-agricultural goods and 9.8% on agricultural goods, Philippine exports to the US are subject to a significantly lower 2.1% tariff. The Trump administration views this as an unfair barrier to American goods and is set to introduce reciprocal measures to match Philippine duties.

Trump’s reciprocal tariff policy is not merely about adjusting duty rates. It is also a strategic maneuver to extract key trade concessions from Manila. The US is expected to push for:

Trump’s imposition of reciprocal tariffs signals a pivotal moment in US-Philippines trade relations. While the move is designed to address long-standing trade imbalances, it also presents an opportunity for the Philippines to negotiate a more sustainable and mutually beneficial economic partnership with the US.

We must also take into consideration how Philippine economic stability is linked with geopolitics, specifically, the possible reduction in US military presence in the ASEAN region. The US currently plays a key security role in the West Philippine Sea, where Chinese claims of sovereignty conflict with those of littoral Southeast Asian nations. The Philippines is among the countries that would be most vulnerable to this shift, considering how President Ferdinand Marcos Jr. has reinforced military relations with Washington.

In recent years, Manila has experienced repeated clashes with China’s coast guard, raising fears of an escalation. With a reduced US commitment, ASEAN claimants in the South China Sea — Vietnam, Malaysia, Brunei, Philippines — could feel increasingly exposed to the Chinese threat of aggression. Should Washington signal disengagement with these ASEAN claimants, the Philippines, in particular, would have to re-evaluate its alignment with the US and may need to seek alternative security partnerships with other countries, such as Japan, Australia, Canada, and India.

Manila now faces a critical decision: comply with US demands to avoid tariff hikes or risk retaliatory measures that could impact its economy. The outcome of these negotiations will shape the future of bilateral trade, influencing economic and geopolitical dynamics for years to come. – Rappler.com

In this piece, data cultivation and analysis were done in collaboration with Washington-based fund manager Eric Jurado of the Institutional Investor who agreed to team up with Vantage Point from time to time to deliver relevant market and economic valuation for our countless readers.